green card exit tax irs

Giving Up a Green Card. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to.

Us Expatriation Tax 2021 Exit Tax After Renouncing Citizenship

Green card holders are also affected by the exit tax rules.

. You generally have this status if the US. That is because in many circumstances legal permanent residents who do not properly give up their green card aka. There are three.

Person loses its luster. You will first provide your name and legal resident address information Green Card Form I-551 information and the location from where you are submitting. Exit tax applies to United States expatriates a term describing people who have renounced their US citizenship and those who have renounced a Green Card that they have held for at least eight years.

To calculate any exit tax due to the US person for surrendering a Green Card an IRS Form 8854 is used. The general rule is for US Green Card holders who have been in the US for 8 of the last 15 years or more with assets less than around 2 million they should escape any taxation. Noncitizens Who Face the Exit Tax.

After being a holder for 8 or more of the last 15 years. Not everyone is taxed as they leave. Your risk exists if.

When a US person gives up their green card it can be a very complicated ordeal from an IRS tax perspective. Citizens who relinquish citizenship and green card holders who renounce their status and leave the US. Status it is important to be sure that they engage in proper planning before giving up the green card.

Generally it takes a few months to hear back. From an immigration perspective it is relatively straightforward the person usually files a Form I-407 by mail and waits for approval. You are a long-term resident which means you have held a green card in at least 8 of the previous 15 years IRC 877 e 2 877A g 5.

A long-term resident is an individual who has held a green card in at least 8 of the prior 15 years. Giving Up a Green Card US Exit Tax. Surrendering a Green Card US Tax.

Someone who is a US. The exit tax process measures income tax not yet paid and delivers a final tax bill. For Green Card holders to be subject to the exit tax they must have been a lawful permanent resident of the Unites States in at least 8 taxable years during a period of 15 taxable years ending with the taxable year during which the expatriation occurs when you give back your green card.

Underpayment of taxes can result in fees ranging from 20-40 of owed taxes depending on the circumstances and severity of the underpayment. Only green card holders are taxed. The pre-2008 version of the exit tax law for definitions.

Exit Tax is a tax paid on a percentage of the assets that someone who is renouncing their US citizenship holds at the time that they renounce them. Taxpayer because of spending too many days in the United States can terminate US. This is required for certain US.

A deferral request can be filed with the IRS. Surrendering a Green Card US Tax. For many Legal Permanent Residents once they learn about the IRS tax liabilities for being a Green Card Holder along with the potential future exit tax being a US.

Failure to file a tax return as a green card holder is punishable by fees of 5 of the total owed balance of taxes compounding up to 25 for continued failure to pay. You are a lawful permanent resident of the United States at any time if you have been given the privilege according to the immigration laws of residing permanently in the United States as an immigrant. The IRS Green Card Exit Tax 8 Years rules involving US.

Paying exit tax ensures your taxes are settled when you. If you make the election to be a nonresident of the United States for income tax purposes you risk triggering the exit tax. The code section is broken down by first identifying the basics of the purpose of the code section followed by definitions of which individuals may be subject to exit tax.

An exit tax will be assessed if an individual meets one of the following requirements. It is the IRSs last chance to tax you. If you decide to abandon your US residence the first step is completing Form I-407 Record of Abandonment of Lawful Permanent Resident Status.

In June 2008 Congress enacted the so-called exit tax provisions under Internal Revenue Code Section 877A which applies to certain US. A green card holder must have been a lawful permanent resident in eight of the 15 years ending with the year of expatriationin other words the green card holder is a long-term resident a defined term in the IRC. Tax evasion and conspiracy to defraud.

This form is fairly straightforward. To put this simply if you held your Green Card for a. In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or green card.

The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. Currently net capital gains can be taxed as high as 238. Importantly until those requirements are settled you will remain a US person for tax purposes.

Long-term residents who relinquish their US. This is known as the green card test. Citizenship and Immigration Services USCIS issued you a.

Person gives up their green card and no longer wants to have any US. You cease to be a lawful permanent. As a result the green card holder wants to abandon their green card status and give up their US.

Irs Streamlined Program Explained Expat Tax Online

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Usa Internal Revenue Service Irs Employer Identificatio In 2022 Employer Identification Number Internal Revenue Service Templates

Exit Tax Planning New Expatriation Exiting Us Tax System

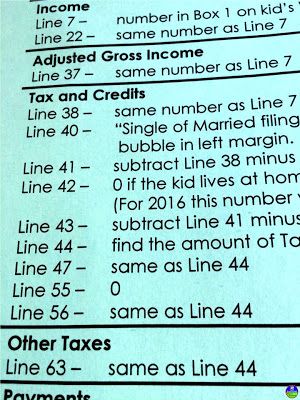

1040 Income Tax Cheat Sheet For Kids Income Tax Consumer Math Financial Literacy

Irs Exit Tax For U S Citizens Explained Expat Us Tax

Tax Tip Verifying Your Identity To Access Certain Irs Systems Tas

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Green Card Exit Tax Abandonment After 8 Years

The Role Of Irs Form 8854 In Renouncing Us Citizenship Expat Tax Professionals

Tax Resident Status And 3 Things To Know Before Moving To Us

Renouncing Us Citizenship Expat Tax Professionals

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Usa Visa Template Immigration Document To United States American Green Card Mock Up Visa Card Numbers Green Card Usa Templates

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Irs Form W4 How Many Allowances Should I Claim Payroll Taxes Irs Forms Income Tax Return

Exit Tax In The Us Everything You Need To Know If You Re Moving

How A Treaty Tie Breaker Provision May Save Departing Long Term Green Card Holders From The Expatriation Tax Sf Tax Counsel

The Goal Of A Board Meeting Should Be To Maximize The Value You Get While Minimizing The Amount Of Time You Spend Preparing Of Cour Deck How To Plan Big Picture